Debt consolidation is a popular strategy for managing debt that involves taking out a single loan to pay off multiple debts. Debt consolidation may simplify your finances, reduce monthly repayments, and save money on interest charges. In this blog, we’ll explore the concept of debt consolidation in more detail and provide some tips on how to make it work for you.

What is debt consolidation?

Debt consolidation involves looking at your existing loans and consolidating multiple debts, such as credit card balances, personal loans, or ATO debt, under a single loan. The idea is to consolidate all your debts into a single monthly payment, which can help you stay organized and reduce the interest you’re paying overall.

There are two main types of debt consolidation loans:

- Secured loans: These loans require collateral, such as a home, to secure the loan. If you have a mortgage, refinancing your property and consolidating your debts might save you hundreds of dollars in repayments. Secured loans typically have lower interest rates than unsecured ones, but you risk losing your collateral if you cannot make payments.

- Unsecured loans: These loans do not require collateral but typically have higher interest rates than secured loans.

Benefits of debt consolidation:

- Simplify your finances: With only one monthly payment, you can streamline your finances and focus on paying down your debt.

- Lower your interest rate: If you have high-interest debt, such as credit card balances, consolidating your debt by refinancing your property with a lower interest rate loan can save you money on interest charges.

- Lower your monthly payment: By consolidating your debt, you can lower your monthly payment, making it easier to manage your finances.

- Improve your credit score: Consolidating your debt can help improve your credit score by reducing your credit utilization rate (the amount of credit you use compared to the amount of credit available).

Tips for successful debt consolidation:

- Understand your options: There are many different types of debt consolidation loans available, so it’s essential to research and understand each option’s pros and cons. The most common strategy is to consolidate your debts under your mortgage with a lower interest rate by refinancing.

- Consider your credit score: Your credit score will significantly determine the interest rate you can get on a debt consolidation loan. Consider improving your credit score before applying for a loan if your credit score is low.

- Avoid taking on more debt: It can be tempting to use the extra money from a debt consolidation loan to take on more debt, but this will only make your financial situation worse in the long run.

- Create a budget: Once you’ve consolidated your debt, it’s essential to create a budget and stick to it. It will help you stay on track and avoid falling back into debt.

- Consider working with a professional: If you’re feeling overwhelmed by your debt, consider working with a professional, such as a financial advisor or credit counsellor, who can help you create a plan for paying off your debt and managing your finances.

Debt consolidation is not a magic solution to your financial problems, but it can be a helpful tool for managing debt and improving your overall financial situation. By reviewing your debts and staying committed to your financial goals, you can successfully consolidate your debt and take control of your finances.

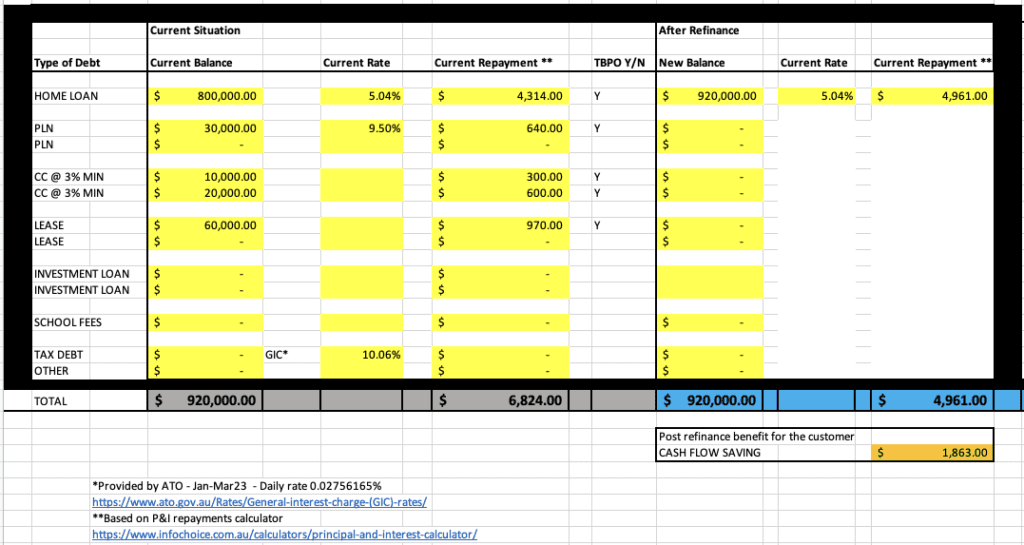

Here’s a sample worksheet with some numbers in the context of debt consolidation. The left side (Current Situation) displays the current debts and the right side (After Refinance) shows the future single repayment after refinancing and consolidating all debts under the home loan.

If you need help in consolidating your debts by refinancing your home loan, contact us for obligation-free chat.

Image by kstudio on Freepik